Mortgage Services

Quality Services at a Great Value. Secure, Reliable and Fast.

The recent, rapid transformation of the mortgage banking industry means you must devote 110% attention to stay ahead of the changes. The questions faced by mortgage companies today is that – can you become more efficient and nimble than your competition? Are you ready to seize the emerging opportunities that come from a more competitive environment while also staying compliant to CFPB, OCC and GSE rules?

Since early 2000s, C-Metric has supported large and small mortgage companies by helping them reduce their process timelines, lower their staff costs, reduce errors, and be more responsive to the dynamic demands of the industry and regulators.

C-Metric Has Been Successful in Helping Our Clients

- On board new loans or new cases in your system or record

- Audit incoming data, perform manual clean up and QA steps and request missing information more efficiently and at a lower cost

- Quickly accommodate new and emerging process and compliance requirements

- Stay on schedule with third party hand-offs and follow up tasks with participants such as county record offices, attorneys, REO realtors, bank-owned servicers and default management companies

- Clean-up transferred records with missing or bad data

- Split-up and index PDF large volumes of loan files images, and organize them in your document management system

- Create and execute detailed process maps related document preparation and fulfillment

C-Metric Services

- Loan File Audits (20-data-points, 30-data-points, custom designed)

- Doc Drawing, Closing Package Preparation

- Pre-Underwriting and Post-Closing Loan File Processing

- Loan File QA – During Onboarding, Pre-Underwriting, and Portfolio QA

- Image Splitting and Indexing

- Document Preparation and Document Stacking

- File Preparations for Regulatory Agency Audit

- Call Monitoring for Quality Control of SPOC and Call Center Agents

- Reporting and Data Mining

- Lien Release

- Title Curative Support

- Business Process Mapping

- Custom Processes to Suite your Specific Requirements

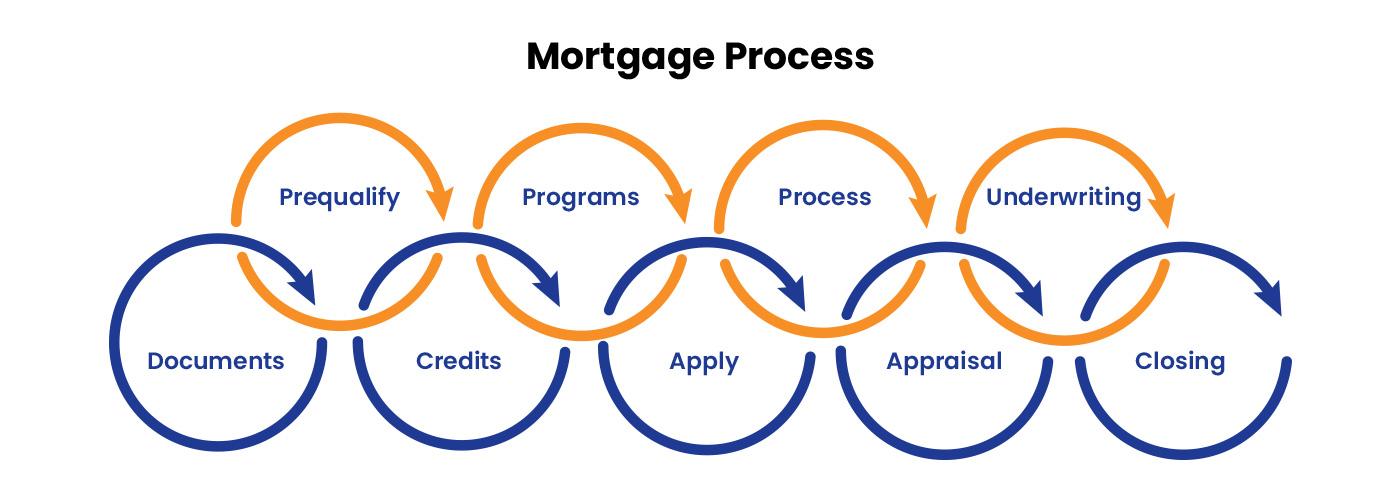

Mortgage Processing Services

Our Delivery Model

We deliver our services through a Variable Cost Capacity model that help our clients to save as much as 50-70% in operating cost, protect margins, and streamline processes, so you can focus on delivering your core products and services to your customers.